Music, hello and welcome to an overview of the purpose and highlights of the Income Allocation for Non-Obligated Spouse (NOS) form. - This form is used by the Michigan Department of Treasury when holding a joint income tax refund or credit payment, and if one or both spouses have debts for taxes or other debts to the state or state agencies, such as friend-of-the-court, unemployment, garnishment, or levy. - The NOS form is utilized to divide the joint refund amount into single refund amounts for each spouse. - The refund amount for each spouse will be applied to their individual debts, and any remaining amount will be refunded to them. - Unlike the Injured Spouse form, which is filed along with your federal tax return, the NOS form is filed after your state of Michigan tax return has been filed and processed. - Once your state return has been processed and if there is a garnishment or levy on record, a personalized NOS form will be created using the information from your Michigan return. - Your NOS form will be sent to the address on your return, and you will have 30 days to complete and return it to the state Treasury. - For proof of delivery, it is recommended to send the form by certified mail, and it is also advised to make a copy for your own records. - Because the 30-day window is limited, it is important to immediately notify the Michigan income tax department of any change of address. - This can be done by calling them separately. - Separate NOS forms will be sent for State Treasury debts and for third-party debts. - Additionally, separate NOS forms will be sent for each tax year returned and for each amended return. - Music.

Award-winning PDF software

Non obligated spouse Form: What You Should Know

You cannot reduce you owe to zero. You may contact the Tax Department or the New York State agencies to get this form. Do not file this form. You cannot reduce your unpaid tax liability to zero. Do not pay any past-due amount. (You can still have the state tax deducted from your federal tax.) If you have been charged with a crime related to the payment of back taxes, you may be liable for these charges. You must wait 3 years from the date you paid the tax after you filed the tax return, for the criminal charges to become final, or a civil trial to commence. If it becomes final after the 3 years have expired, you may request that the state court order discharge of the criminal charges against you. No action may be taken to recover the unpaid tax amount. If you need immediate assistance, please contact the Non-Obligated Spouse Information Service (ISIS) at the New York State Department of Taxation (New York State Tax Paid Telephone: +). If you know is someone owes you back taxes, and you think this may be your obligation, contact the Tax Paid telephone number before you file your return. How can I help you? You can assist the Tax Department by answering the question about the amount and date of the payment and the Tax Department may send you a form to obtain this information. Note: If you have been charged with a crime related to the payment of back taxes, you may be liable for these charges. You must wait 3 years from the date you paid the tax after you filed the tax return, for the criminal charges to become final, or a civil trial to commence. If it becomes final after the 3 years have expired, you may request that the state court order discharge of the criminal charges against you. No action may be taken to recover the unpaid tax amount. If you need immediate assistance, please contact the Non-Obligated Spouse Information Service (ISIS) at the New York State Department of Taxation (New York State Tax Paid Telephone: +). If you know is someone owes you back taxes, and you think this may be your obligation, contact the Tax Paid telephone number before you file your return. Note: If you have been charged with a crime related to the payment of back taxes, you may be liable for these charges.

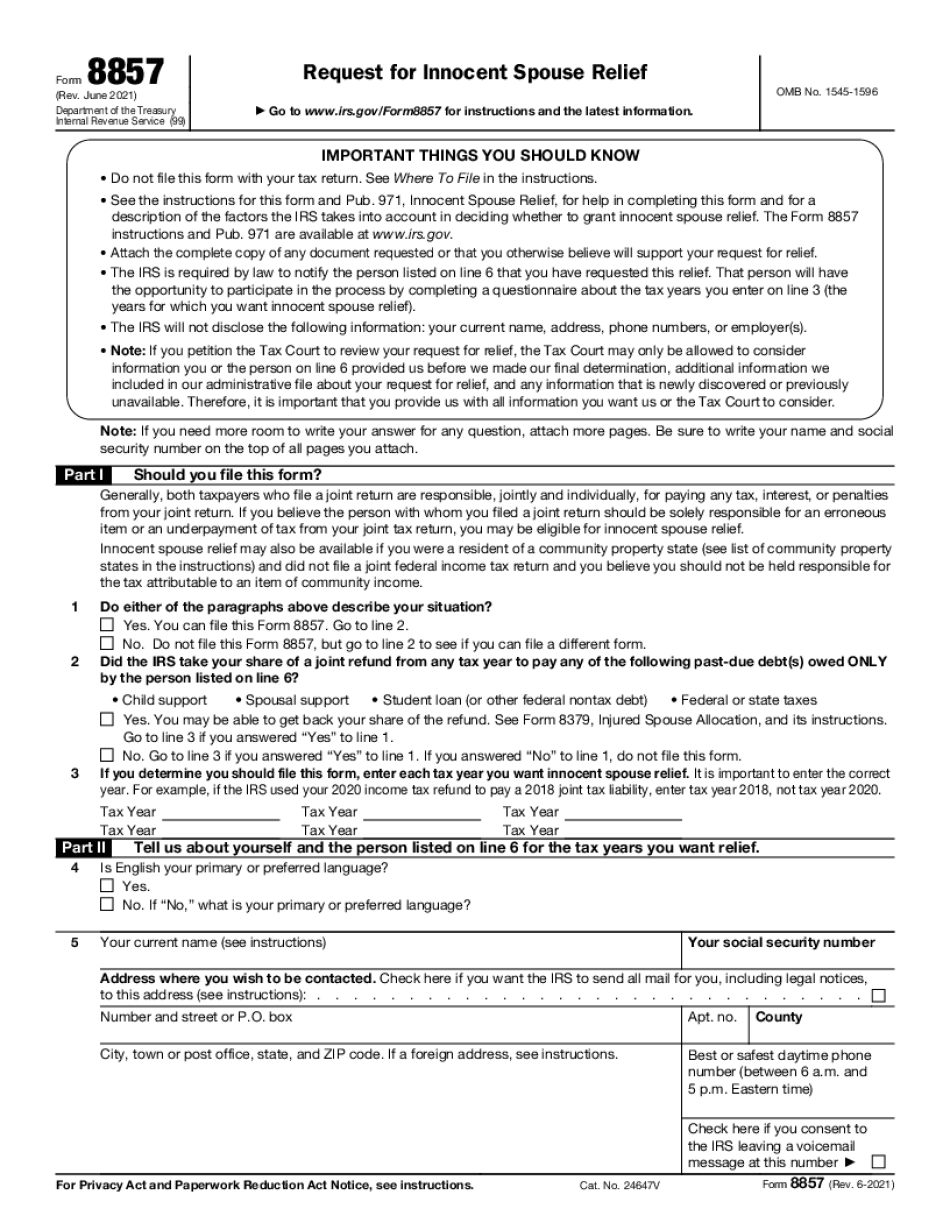

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8857, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8857 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8857 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8857 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Non obligated spouse form