Hello, hello, good morning. Give me a moment to get on and get my notes. Here, my desk is a wreck right now, which is totally uncool. So, after I get done with this, I'm gonna have to get organized. Yeah, that's just it. Okay, so when you pop on, let me know who you are and where you're from, so I can shout you out and say hello. And if you're watching this on my YouTube channel, thank you and make sure you subscribe so you don't miss anything. And if you have some comments or questions, make sure to leave them because I do respond to those. So, let us get down with the content for today. So, the tax question I got was about married filing separately or injured spouse, which one is better? So, I'm going to talk about that in just a moment. And let me share this in one other place. Hello there, little sister. How are you? Your nephew's birthday is tomorrow. Yeah, laughter. Okay, so let's get down with the get-down, alright? So, I got the task question about which is better to file, which filing strategy is better, to file married filing separately or to file injured spouse. So, let me explain what an injured spouse is. Most people understand married filing separately, well let me explain injured spouse. Injured spouse is a type of form that you file, and I completely forgot the form number, but what it does is that it separates one spouse from another's liability. So, it could be an issue of owing for taxes, child support, student loans, or anything like that. If you have one spouse that has these liabilities, what the other spouse can do is file an injured spouse form in order for you to...

Award-winning PDF software

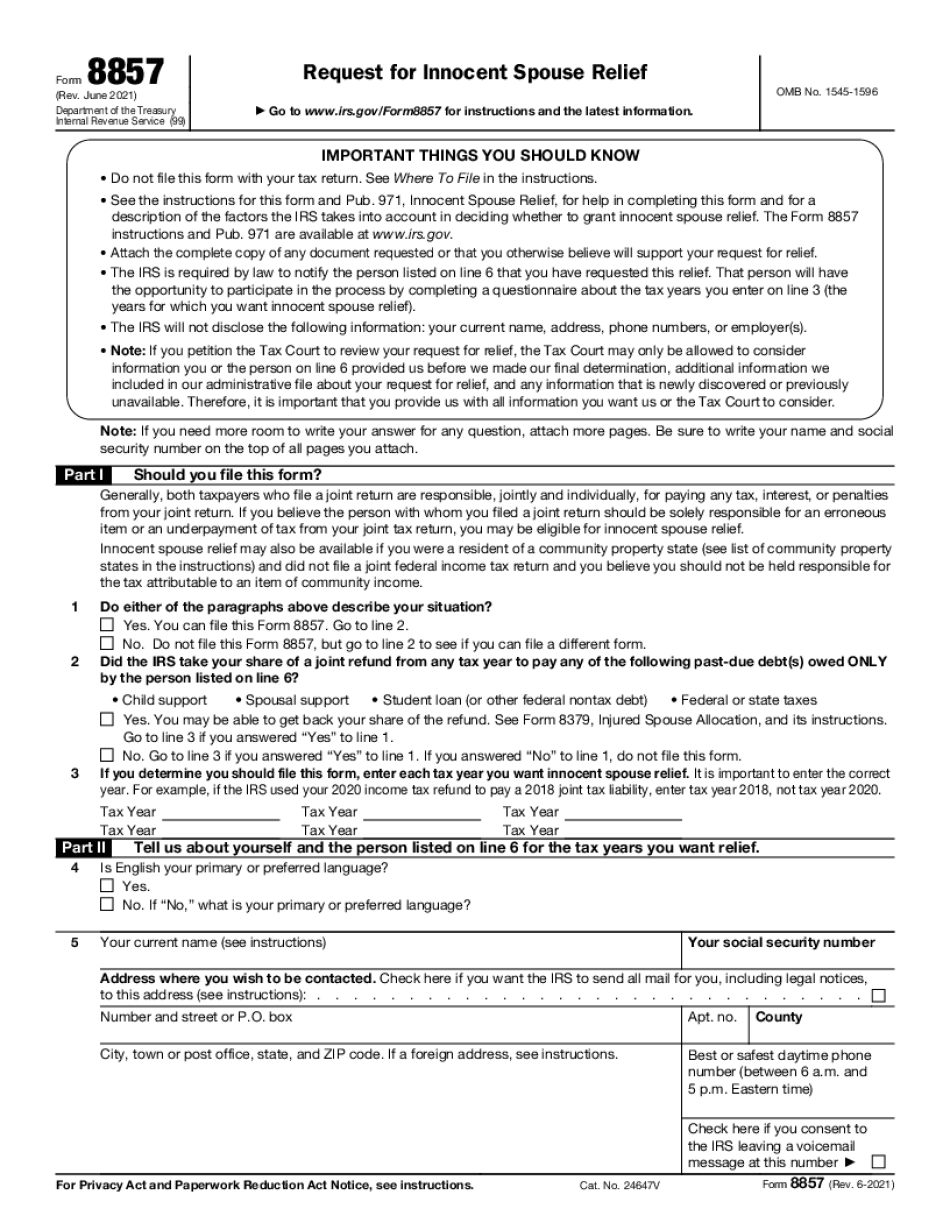

Innocent Spouse Relief Form: What You Should Know

Time Period in the Form 705 and include information that substantiates that you can demonstrate that an unmarried or dependent child was a dependent for at least one Month on the date you filed your return, and provide your signature. Spouses and Dependents. Provide the information required to determine whether the person you or your spouse was dependent for at least one month during the Time Period in the form 705 and indicate whether you or your spouse was determined to be a dependent by the IRS by providing information that substantiates that you have a child from a previous marriage or a dependent child who is a graduate student or was in higher education at the time of filing your return, or a person from whom you or your spouse received a child who has become a full-time student. Nonrequesting Spouse/RDP Information. Provide the information below. Nonrequesting Spouse/RDP Information. For the purposes of making a request for innocent spouse relief, you must be a non-requesting spouse or a parent of a child for whom you became a parent after the marriage or birth of a child. You must file a Form 8857 with your return and, for each spouse who is not a requestor for the innocent period, provide to them as required in subparagraphs (f) through (i), (l), or (m), and subparagraph (z) of section 2639.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8857, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8857 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8857 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8857 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Innocent Spouse Relief Form